Half Empty or Half Full

February 26, 2020

Where is Your Blueprint?

February 26, 2020Follow Your Dream, But Plan

It’s so important for business owners understand all their options when it comes to financing for their businesses. Small and Medium size businesses are the steam engine that fuels the U.S. economy. They are the innovators that take us to the next service level or the product that changes our lives. If these businesses are struggling or fail, it hurts all of us.

Each one of you has spent so much time working on your business: long, long hours, days, weeks or even years. So many times I’ve talked with the business owner about surviving, ways to get more business, ideas to get over hurdles, be it their competition, expansion, or even that first customer order. Even discussing the fact of whether they really want to open their own business, or stay on the safe corporate side.

Self doubt can undermine the greatest idea, and your courage to move forward. Yes, it takes courage to make that giant leap to start your own business and continue when things don’t quite work they way they should. The discipline that goes with this decision is a major requirement to success, mentally, emotionally and sometimes physically.

Try to alleviate some of this stress. You cannot do it all, accept that and act on it. One avenue that causes premature failure is financing as well as causing serious stress and distraction. It can lead to poor decisions as well. Explore the various avenues available, and keep an open mind. What is necessary to survive today, may be totally different that a year from now.

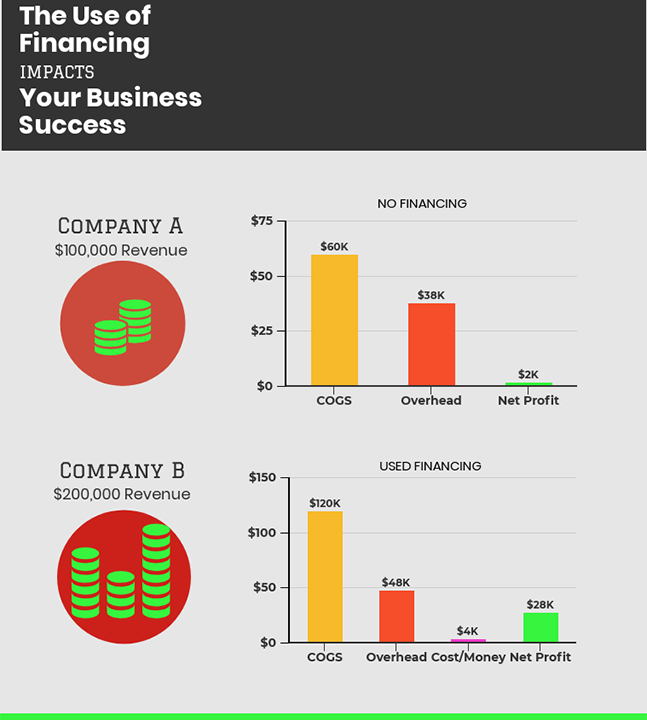

There are various types of financing other than traditional bank loans to small and medium size businesses for many years. Whether they are in Start-up, Growth, or Survival Mode, many times financing is available.

For almost 20 years I have watched while a large number of business owners bury themselves in credit card debt, loans, or worst, give away equity in their company for the need of cash flow. Others use up their savings, even mortgaging their homes, thinking they will repay themselves in just a few months.. The majority of these business owners continue to struggle to make ends meet. Many, in discouragement, give up, and go back to their job working for some else, never realizing their dream. We are still recovering from the economic downturn of 2008. Everyday some idea stagnates or disappears because of lack of cash flow.

Not every financial problem can be solved with outside financing, but many can be, or can alleviate the immediate situation. There are various financial options available to businesses which many do not know about or do not understand how they work. Take a little time, just a few hours, and look into what is available, and how you can use it.

Nothing is going to be the perfect fit. However, if you can look at your business and see where one of these financing options can work, you have achieved a more stable basis for your business to move forward.

If you would like more information on business financing please contact me at: agord@swbell.net or 1-877-872-4879