Yes, This can Really Simplify Your Business

February 26, 2020

CASE STUDY: I Couldn’t Even Buy Food

February 26, 2020Simplifying Your Business

Every day, we read or listen to a way to make our life easier. Whether it’s the new laundry detergent packet (no more measuring), the self-driving car, or setting your alarm from your phone, daily tasks are easier than they used to be.

In business we can now have Drop Box and Google Docs for file sharing. Quickbooks, Peachtree and Fresh Books, just to name a few accounting options. Marketing has become a whole new world with Social Media. Even Post a Notes and Day timers are obsolete.

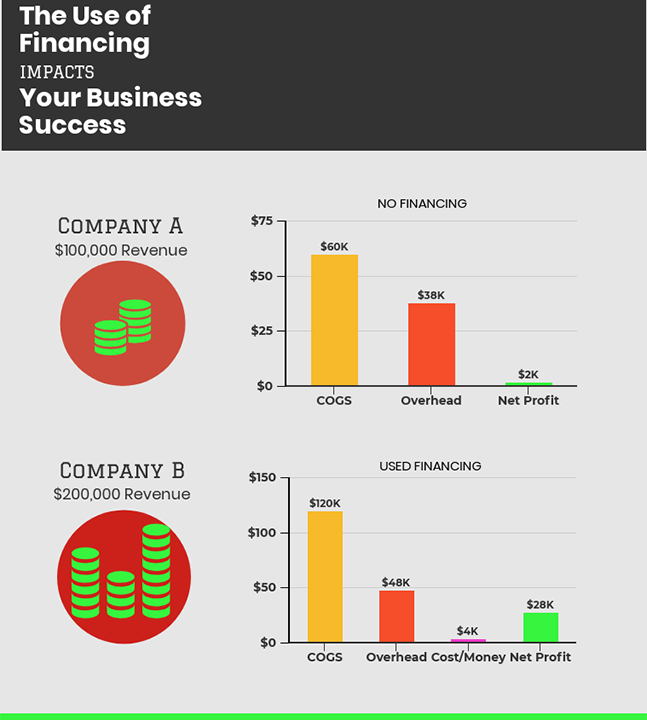

But, when it comes to financing your business it’s still a struggle for many.

The traditional bank loan comes to mind immediately. The long application, the stacks of documents, and then you wait, and wait, and wait. The chances are slim that a young business will qualify for a business bank loan. And, it is a loan, which means you have just added another payment to your monthly bills. Your company now has debt.

Now there’s the quick fix of an MCA/ACH loan. You get this lump sum into your bank account. You pay your bills, and breathe a sigh of relief. Then every day or every week, there is an automatic deduction from your bank account. This is fine for a while, but then, once again, your bills are due, which you pay, and then the automatic withdrawal, puts you in an overdrawn situation. And, more fees are incurred, putting you farther into a negative balance. Most of the time, these loans have a very high interest rate, and they must be paid off, before you can get more money.

Factoring/Invoice Financing is used by thousands of businesses around the world to grow their businesses without debt, or giving up equity.

What people don’t think about is the major back office functions that factors do as part of their service to their client. This is in addition to improving your Cash Flow and helping you grow without debt.

Questions?

Call or Email:

Anne Gordon

agord@swbell.net

1-877-872-4879