‘STRIVING TO WIN,’ NOT ‘TRYING NOT TO LOSE’’

March 19, 2020

Stress and Sleepless Nights, Doesn’t have to be this way.

March 19, 2020Every day, we read or listen to a way to make our life easier. It’s the new laundry detergent packet (no more measuring) to the self-driving car.

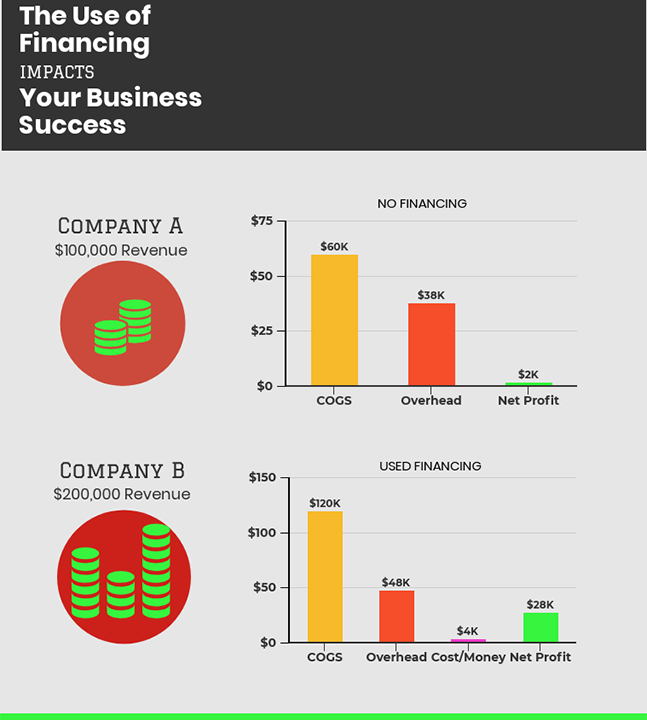

When it comes to financing your business it’s still a struggle for many.

The traditional bank loan comes to mind immediately. The long application, the stacks of documents, and then you wait, and wait, and wait. The chances are slim that a young business will qualify for a business bank loan.

Now there is the quick fix of an MCA/ACH loan. You get this lump sum into your bank account. You pay your bills, and breathe a sigh of relief. Then every day or every week, there is an automatic deduction from your bank account. This is fine for a while, but then, once again, your bills are due, which you pay, and then the automatic withdrawal, puts you in an overdrawn situation. And, more fees are incurred, putting you farther into a negative balance. Most of the time, these loans have a very high interest rate, and they must be paid off, before you can get more money.

Think about Factoring/Invoice Financing

Using Factoring improves Cash Flow without giving up equity or going into debt.

Those are the two obvious values/advantages of factoring that come to mind immediately when mentioning factoring. Steady Cash Flow/paying your bills on time and Grow Your Business

What people don’t think about is the major back office functions that factors do as a matter of course in managing your account.

- At the front end, they advise you on the credit-worthiness of your customers, before you do business with them. Do you really want to start working for or shipping to a company that is paying 75 days behind terms? A factoring company gives you a credit check on a potential customer, BEFORE you start working with them. Your choice: you can still do business with them, but the factoring company is not going to advance you money on an invoice for that customer. You’re on your own!

- 80% of invoices that are late, are not paid because they are “LOST.” I know, you sent it in the mail, you emailed it, you faxed it. It just got LOST. When you finally realize that it has not been paid, and call, then you find out the customer has no record. You start from Day 1 again. A factoring company, (1) sends out your invoices, (2) makes sure the customer has received the invoice (3)makes sure that the customer is satisfied with the service/product, and (4) agrees to pay the invoice- the most important part.

- A factoring company gives you a complete back office. Can your company afford this necessary part of your business on its own? Do you have someone dedicated to sending out your invoices, checking to make sure they are in your customer’s system, that the customer was satisfied with the work, and that the invoice is scheduled for a certain date to be paid? The answer is, probably “No.” A factoring company gives you a complete back office, as part of their regular service.

- Accounts payable people are used to working with factors, and respond to their calls and emails in a timely manner. It’s the same person they speak to every month, and a business relationship is established. Accounts payable people understand that factoring companies follow up on invoices. They don’t view them as a Collections company.

- Most factors have an online service where your account is accessible 24/7. No more figuring out what is paid, what is old, was the invoice sent out. It’s right there in The Cloud. Is your accounting that up to date, and that accessible? Is your back office on top of everything all the time? If you’re the one doing all this, the answer is ‘No.’ Sooner or later, something will slip through the cracks.

- Steady, Predictable Cash Flow. The stress of waiting to get paid, using your credit cards or dipping into your savings while you wait takes a heavy toll on the business and the business owner. Instead of cultivating new clients and reconnecting with your current client base, you’re chasing payments, balancing what you can pay now. It’s hard to be focused on everything (actually it’s impossible) that needs to be done in a business. No one has the energy and time to do everything. Not even you!

- Going into Debt. While this is one of the two obvious and most important advantages to factoring, people just skip over them a good deal of the time. Having a Debt-Free company is very important to your company’s health and growth. Remember, factoring is not a loan, it improves Cash Flow, by advancing money on your invoices, instead of waiting to get paid by your customer.

- Giving up Equity has a major impact on the way you run your business. You want an investor because you need money. Have you thought about the fact that you are now accountable to that person or persons who invested money? No longer are you in charge of decision making. Any changes or ideas must be presented and approved by the now other owner of your company. Reports must be submitted to them on a regular basis. You are once again, working for someone, not yourself.

Growing without debt makes your company more profitable and stronger. Establishing good business credit like paying your bills on time is hard if you don’t have steady, predictable cash flow. And, ultimately, you want your business, as well as personally, to have good credit.

Factoring is used throughout the world by businesses large and small, and has been since Biblical Times. Improve your Cash Flow and get Peace of Mind.

At Guilin Funding we have been helping businesses just like yours grow and thrive in today’s rapidly changing economy. Give Anne Gordon “The Money Lady” a call directly at (877) 872-4879