How Does Factoring Simplify Your Business?

March 19, 2020

DON’T ROLLOVER AND GIVE IN

March 19, 2020You had a great idea. You developed your product. Then you put together your plans. You did everything by the book You started your own business. You followed your plan, planned your budget, and kept to it. As you presented your product customers bought. This is what is supposed to happen. The business has begun to grow. You’re so excited. You’re working long and hard, but it’s worth it. Success is coming in to you. You are interviewing additional help for the business.

Your business is growing, but so are your bills. Your business, and your personal, home bills are coming due, or are overdue. So, you dip into your savings, and you use your credit cards. These can be paid back when you get paid. This continues for a few weeks. Then the nagging starts in the back of your mind distracting you from sales, marketing, and the next product you want to introduce. You’re thinking, the checks will be here today, well, surely tomorrow. How much do I have left in my savings? How long can I manage to stay afloat? I must pay my people, the phone, the rent, and my own mortgage. Stress and sleepless nights.

Well, how many weeks do you have left in the bank to fund No matter what, you must pay your people, your utilities, the phone which brought the orders in. It is all piling up. But, surely, tomorrow will bring the needed checks from the customers.

A bank loan is not always an option for a business. They take a long time in ‘committee,’ and small businesses don’t often qualify. An MCA loan is very expensive. While you get a lump sum, the interest rate is very high, and the automatic withdrawals from your bank account can happen at just the wrong time, leaving you overdrawn, and with large, continuing overdraft fees.

If you are waiting to get paid on invoices to commercial creditworthy customers and/or government agencies, factoring can improve your cash flow, and help you grow your business without going into debt.

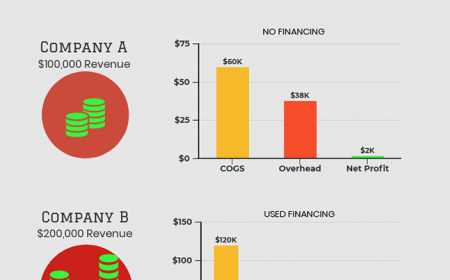

Who do you want to be? Company A or B

Company A doesn’t use any Financing. They made

$2000 or 2%on revenue of $100,000. No one can

live with that kind of margin.

Company B used financing, and built their revenues

to $200,000 and $28,000 or 14% profit.

We can use your invoices to creditworthy

businesses and/or government agencies and

speed up your payments. You get cash today,

instead of waiting 30-45-60 days

AR Financing, also known as Factoring, has been

used worldwide since Biblical Times. It accounts

for over $500 Billion in Commercial Lending every

year, and is used in all industries. This is not a

loan-so there is no debt to your company. This is

IMPORTANT. You don’t want to add debt. No loss

of equity in your company. Why give away part of

your efforts, and become accountable to someone

else again.

Put your business on the track for success. We love helping businesses succeed. Let us help you.

At Guilin Funding we have been helping businesses just like yours grow and thrive in today’s rapidly changing economy. Give Anne Gordon “The Money Lady” a call directly at (877) 872-4879