Poor Cash Flow-#1 Reason most small and medium size businesses fail.

March 19, 2020

How Does Factoring Simplify Your Business?

March 19, 2020This phrase stuck out in my mind from a recent article I read. It’s like asking someone how they’re doing. “Just hanging in there, just barely.” If that’s your mindset, it a recipe for failure.

You’re just treading water, and you can’t tread water forever…You go under for good! Waiting an average of 56 days to be paid, is no way to run a business.

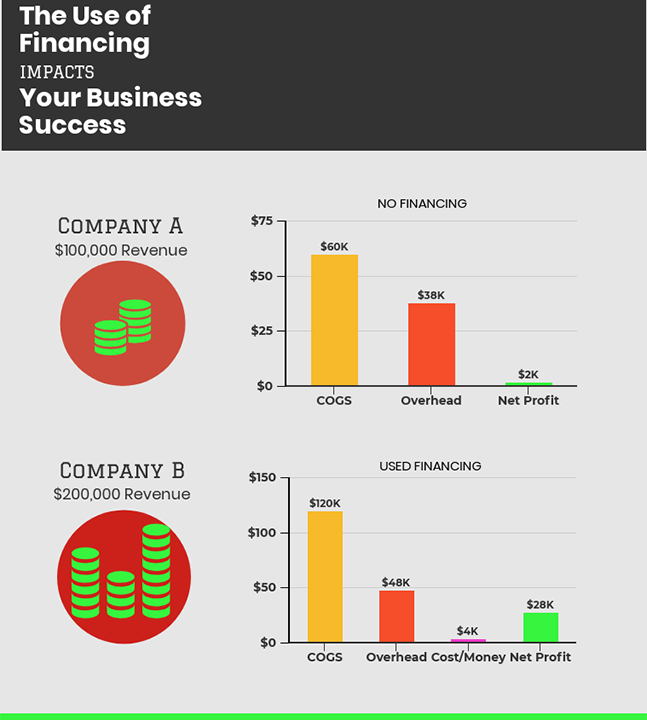

Today’s business climate does not have room for ‘just treading water.’ Every week I hear “If I just could get this much money, I’d be fine.” Really? All that does is cover your current crises, and probably add debt and more payments to your current situation. That loan payment is always due at just the wrong time. And, until that loan is paid off, chances of getting more money are slim, if non-existent.

The situation does not have to be that grim, nor that stressful. With a little planning, improved Cash Flow can usually take care of many problems.

Winning is looking at things differently. ‘That’s the way we’ve always done it, and it’s always worked for us” won’t make it in this economy and business climate. This applies to every aspect of your business, marketing, customer service, products and their presentation, as well as financing.

Good creditworthy customers are taking longer and longer to pay. The 1000 largest public companies in the U.S. took an average of 56.7 days to pay their bills last year, according to a study by the Hackett Group, Inc in a July 26, 2018 Wall Street Journal article. That means you are waiting longer and longer to receive your money. This puts a crimp in every part of the business, and causes unnecessary stress to you, the business owner, as well as your staff. Anxiety creeps in, work deteriorates, and the spiral downward starts and accelerates. How many companies can wait 56 days to receive payments?

Start, right now, with a list of how you will handle things going forward. Staying current with trends, marketing and products is a full time job without adding financing.

Financing needs to be handled on a regular full time basis. Not when you get around to it. Let’s face it, you probably only look at your books when you need to pay something or it’s an overdue bill that was overlooked. Financing, particularly Cash Flow, is paramount to running a successful company.

Factoring your invoices can relieve Cash Flow problems, very easily and fairly quickly. Once you’re set up as a client, you receive your first advance within 24-48 hours of submitting your invoice. The Factoring Company handles your back office, by following up to make sure the invoice is correct, and is received by the AP Department, and is paid in a timely manner. Factoring companies check the credit worthiness of your customer or potential customer before you even sign a contract. This is an amazing service. Consider how much it costs for you to do a check credit on a customer.

Factoring and Trade Finance are estimated to be about $10 Trillion in the global market. It provides consistent Cash Flow for businesses large and small to sustain themselves and grow without debt of loss of equity.

At Guilin Funding we have been helping businesses just like yours grow and thrive in today’s rapidly changing economy. Give Anne Gordon “The Money Lady” a call directly at (877) 872-4879