Follow Your Dream, But Plan

February 26, 2020

The Giant Leap

February 26, 2020Where is Your Blueprint?

“Visualize this thing you want. See it, feel it, believe in it. Make your mental blueprint and begin.”

― Robert Collier

Starting your own business, growing it and maintaining it takes incredible discipline, steadfastness, courage and energy.

People like you are the engine that fuels this economy. Those very attributes along with your imagination and ingenuity are the springboard for the next wave of innovative products and services in this country.

As I talk to businesses about their financing, so many of these issues become part of the discussion.

The need to continue to satisfy existing customers, and engage new customers is part of your daily routine, as well as keeping your services or products up to date. Today’s world with the demand for green products and procedures puts pressure on even the most basic of tasks. Making sure you are compliant with all laws, be they state, federal or whatever adds another layer of stress.

No matter how small or large the business, or what stage (Start-Up, Growth, or Survival), you need a blueprint and follow through.

Blueprint is the key here. Not just a mental blueprint. A solid written plan. It can be changed, modified, torn up, but there should be a plan in place and goals related to the plan.

So many businesses are running in the fog: a prescription for failure.

Take a deep breath and a few minutes.

What do you need? (I always begin with financing-that keeps you in business and on track)

To begin.

Bookkeeper: You want to work on your marketing or your service, or some other aspect of the business. You don’t want to deal with data entry of bills or write checks. Bookkeepers are the helping hand. For a few hours a month they can save you time and money. They keep you organized and when tax time comes, you are ready. You can’t afford not to use a bookkeeper.

Example: I always ask for an AR Aging (Accounts Receivable) and an AP Aging (Accounts Payable) to start the financing package.

The most common answer-“I have Quickbooks, but I don’t know how to do that.”

Second most common answer: “What are those?”

No one expects you to be your own accounting department. You are the creative force, the marketing department, and probably the head salesperson. So get a few hours of help. You can be out of business and not even know it, if you don’t pay attention to your finances.

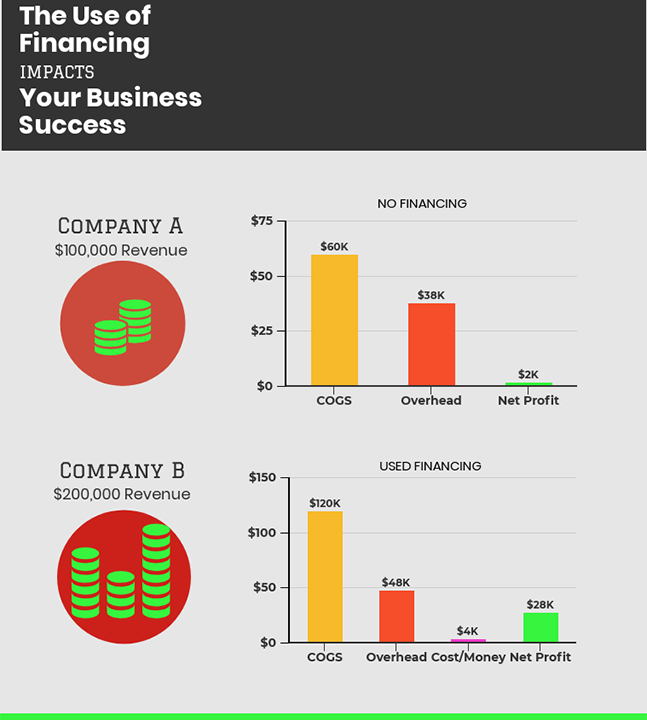

If you need financing, don’t use your personal credit cards or personal savings unless it is truly necessary. You may need those for your family. Evaluate the options available for business financing, and see what fits with your business presently, and in the future. This is just my opinion.

If you would like more information on financing for your business, please contact me at agord@swbell.net or 1-877-872-4879