Your Own American Dream

February 26, 2020

‘STRIVING TO WIN,’ NOT ‘TRYING NOT TO LOSE’’

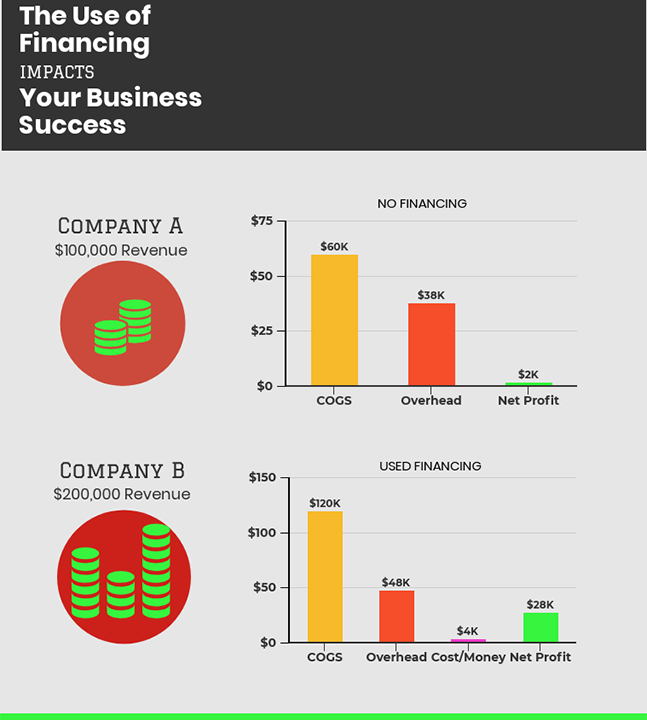

March 19, 2020You know you have to keep your overhead low, but a bill comes along that has to be paid. Usually at just the wrong time. Money, Cash Flow and Collections cannot sit on the sidelines. Cash Flow is the life blood of a business. Without it, bills are not paid, no reorders can be shipped, no new customers can be services. The biggest problem is making payroll. Whether you are a service company, like maintenance or janitorial, or you supply products, you have to pay your workers ON TIME. Without money in the bank, this doesn’t happen.

How to Solve the Problem

Hire a bookkeeper. Don’t do everything yourself. They work remotely, and usually on an hourly rate. This keeps your books in order, and makes tax preparation easy. Paying of a few hours a week give you peace of mind, and helps makes your company efficient.

Don’t fund your company from personal savings and or personal credit cards. You always think you’ll pay yourself back when the checks come in. Rarely does it happen. There’s another need or crisis, and the money goes there. Your savings is depleted, and your credit card balance rise.

Asking Friends and Family for Money. This can sometimes work, but like credit cards and bank loans, they must be repaid. These loans put added stress on personal relationships, and your personal life in general. If you don’t pay them in a timely manner, you’ve also lost a friend.

Bank Loans. Most financial institutions need 2 years of business history, and the company must be profitable. Bank loans can take a long time to get, if you are approved. This puts debt on your company. Another payment to add to your bills. Most of the time, the bank puts an all asset lien on your company. It’s usually in the fine print. This means that your receivables, your equipment, and anything else you might have in the company, are being used as collateral by the bank to secure your loan. If you need more money, and most companies do, the chances of increasing your loan, or getting a new one, are very remote.

ACH/MCA Loans. These are very high interest loans, and money is usually withdrawn from your bank account every day or every week. The approval and access to cash is usually very fast. You get a lump sum of cash, but the repayment schedule is difficult and expensive. Again, in most cases, they will place an all asset lien on your company.

Factoring/Invoice Financing. If you are waiting to get paid, and you’ve invoiced a creditworthy commercial customer and/or government agency, you can receive money for your invoices within 48 hours. Factoring is used worldwide (and has been for hundreds of years). It improves Cash Flow without giving up equity or putting debt on your company. Factoring is available in most industries.

At Guilin Funding we have been helping businesses just like yours grow and thrive in today’s rapidly changing economy. Give Anne Gordon “The Money Lady” a call directly at (877) 872-4879