Case Study: A Start Up

February 26, 2020

What is the CASH in Cash Flow?

February 26, 2020Q1 2016 Ending Now! What Have You Done?

First Quarter of 2016 is ending. Time to reflect (although you probably are so stressed, you don’t have time to reflect)

Have you made your sales goals for the Quarter?

Is your business doing as well as you hoped or even better?

TAXES: One of the problems that looms up at this time of year:

TAXES: Corporate taxes were due March 15th. Were you able to pay them?

TAXES: Then there are quarterly payroll taxes (941’s). Are you current on those?

TAXES: What about past due taxes from prior years? Are you current on those or are they accruing interest and penalties?

TAXES: Personal Taxes are due on April 15th. Are you going to be able to pay those on time?

This time of year is overwhelming when it comes to payments that must be made.

Is there enough money coming in at the right time to make all these payments, and your regular bills? (The Right Time is actually Right Now!) Well, looking at your outstanding invoices, you should be able to get by. If all customers pay on time or ahead of time. Is that realistic? The Big Word here is “IF.”

You think you’re all set, and then an unexpected expense comes up that must be paid immediately. Then you find that your good customer is going to be sending a check in about 20-30 days from now. Not when you really need the money.

Another urgent issue comes up that takes your attention away from the company finances.

When you drag yourself back to the company finances, you have to review where you were. It seems like you’re always waiting for payments, or having to call your customers to see when they’ll be sending the checks. You dislike doing this, worry about offending someone and they’ll stop using your company. It takes a lot out of you, aside from the time and effort to organize the invoices and call on them.

Rarely are these calls rewarding. You get voice mail, sometimes you leave a message, sometimes you just hang up. If you get a live person, the payment information is usually that it is in the system to be paid in the next 30 days. Worse, and very common, is they have no record of the invoice. You start over, resend the invoice. It goes into their system to pay in 30 days. Not what you need.

Your time and efforts could be better spent on new products and services for existing customers, and developing new customers. These are the areas you enjoy and you’re good at developing relationships and products.

By the end of the day or week you are stressed, exhausted, and overwhelmed with the number of issues you have on your plate. Personal time and family time have just evaporated from your schedule. Working the weekend has become the new normal.

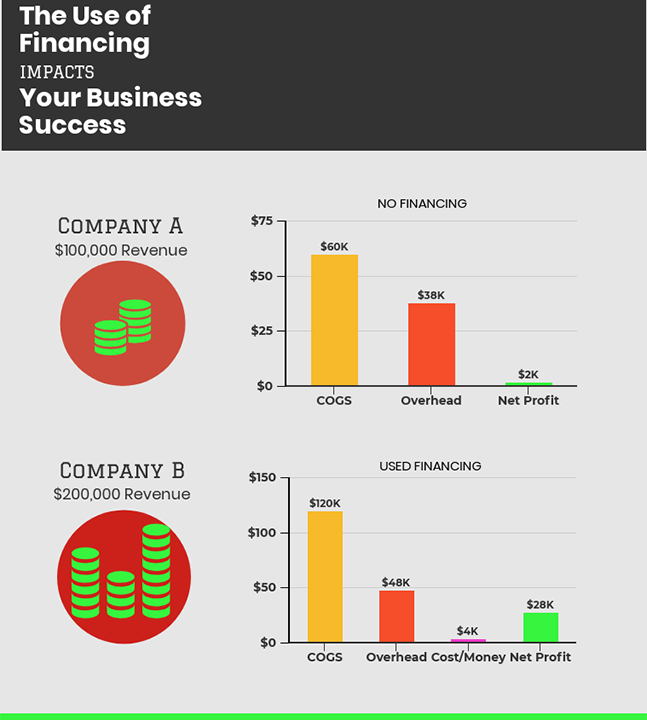

By using factoring/invoice financing, you can have predictable cash flow, pay bills, and devote your time to doing the things you do best to grow your business.

For a Free Consultation and to learn more about financing for your business:

Call: Anne Gordon

Guilin Funding 1-877-872-4879

Email: agord@swbell.net

Visit our website: guilinfunding.com