The Giant Leap

February 26, 2020

Poor Cash Flow-#1 Reason most small and medium size businesses fail.

March 19, 2020Your Own American Dream

Owning Your Own Business: Very few places on this earth give you this opportunity. Seize it, and run with it. Enjoy the thrill of building and contributing something unique to our society.

No matter how exciting, this venture does require some discipline, planning and time. Whether you are are starting from scratch, or at the crossroads with your established business, step back and regroup. Plans and strategies must be put in place or updated all the time. So, set up a monthly, quarterly, and yearly calender to review and refresh. This does not have to be a formal meeting. But choose a time and focus uninterrupted on where you are (in all areas),where you want to be, and the timeline for this next stage. Cover all areas: marketing, management, product development, and finance, just to name a few.

Some questions to ask yourself during this time

- Ideas for your next product or service launch

- What is my competition doing?

- How to reach new markets, and which new markets are you going to focus on?

- How to stay in touch with your current customers and re-engage them?

- What staffing requirements are needed immediately, and in the future?

- Evaluate your finances

All aspects of your business impact the current and future state of your finances.

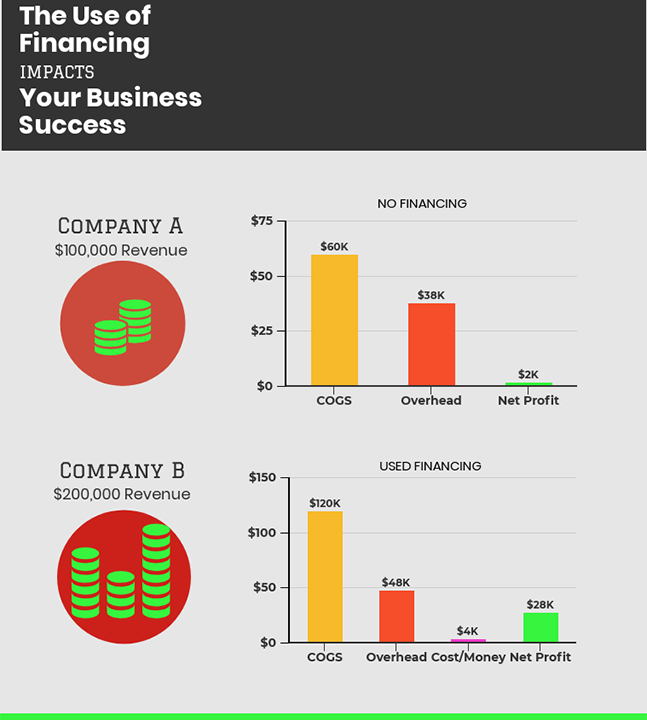

How are you going to finance your business going forward? Do you have sufficient cash flow to keep going as you are? Are you being paid fast enough to keep up with current bills as well as the increase with your planned growth? The majority of business owners must consider, at some point, additionnal financing for many reasons. You are growing fast and your need to expand in many areas, staffing, production, logistics, just to name a few. Do you get paid in a timely manner to keep up with the increased expenses, your regular business bills, as well as your personal bills, with out using credit cards and withdrawing from your savings? You need to do what is best for you. Only you can make the right decision for you and your company. Remember, loans and credit cards add debt to both you and your company. If you are disciplined to pay them off every month, great. That is the way you should work. But, will some event take place, that disrupts your planned payments? Sooner or later it will happen.

Borrowing from friends and family may seem easy at the time. Often it works are beautifully; you pay the loan back, and all is well. Other times, again, due to unforseen circumstances, the repayment does not go as planned. Thanksgiving dinner can end up being pretty stressful with the underlying tension, or the ‘Elephant in the Room.’ Should you get a Bank Loan? Evaluate if this works for your business model. Then apply and get the information necessary to go forward. This can take from a few weeks to a few months, depending on your situation. Remember, you are adding debt to your business. And, before you get too far along, does your business meet the basic qualifications.

Many people want an investor in their business. Ask yourself-What will that do to my business? Do I want to dilute my equity? Do I want to report/answer to someone else? This is my dream, my hard work. If you find and investor (you’ve made that decision) make sure you have all the terms and conditions of that agreement. Can you really satisfy those terms? Money is never free-just remember.

There is factoring/invoice financing. If you have invoices to credit-worthy commercial customers and/or government agencies, your cash flow can be improved very quickly without incurring debt or giving up equity. It can be used while you are waiting for another type of financing.

You need money, but evaluate your options objectively. Literally write out the pros and cons of each scenario.

If you would like more information on factoring and purchase order financing, please give me a call at 1-877-872-4879 or email me at agord@swbell.net

Enjoy your American Dream! You are part of building the greatest economy in the world!